Why is the Indian Market Falling?

Analyzing the Factors Behind the Decline

The Indian stock market, one of the fastest-growing financial markets globally, has recently witnessed a series of declines. For investors, analysts, and everyday traders, understanding the reasons behind this downtrend is crucial for strategic planning and decision-making. In this blog, we explore the factors impacting the Indian market, supported by data, insights, and expert opinions.

Factors Behind the Market Decline

1. Global Economic Headwinds

Global factors such as rising U.S. bond yields and monetary tightening by the Federal Reserve have significantly impacted emerging markets like India.

- For instance, the U.S. 10-year bond yield recently climbed above 4.6%, prompting a flight of capital to safer assets.

- Reference: Marfo.com on U.S. Bond Yields

2. Foreign Institutional Investors (FII) Outflows

FIIs have been net sellers in the Indian market due to higher interest rates in developed economies.

- October 2024 alone saw net outflows of over ₹20,000 crores, a significant dent in liquidity.

- Impact: Sectors like IT and banking have been hit the hardest due to reduced foreign investments.

3. Inflationary Pressures

India’s retail inflation touched 7.4% in August 2024, largely driven by rising food and fuel prices. High inflation reduces consumer spending, thereby slowing down economic growth.

- Sectors Affected: FMCG, Auto, and Consumer Durables.

4. Geopolitical Uncertainty

Global tensions, such as the Russia-Ukraine conflict and tensions in the Middle East, have led to higher oil prices.

- Crude oil trading above $95 per barrel directly impacts India, which imports over 80% of its oil requirements.

- Rising oil prices weaken the rupee and add to fiscal pressures.

5. Domestic Policy Concerns

- Recent delays in government infrastructure projects and subdued quarterly corporate earnings have added to investor concerns.

- Policy uncertainty in critical sectors such as telecom and renewable energy further impacts sentiment.

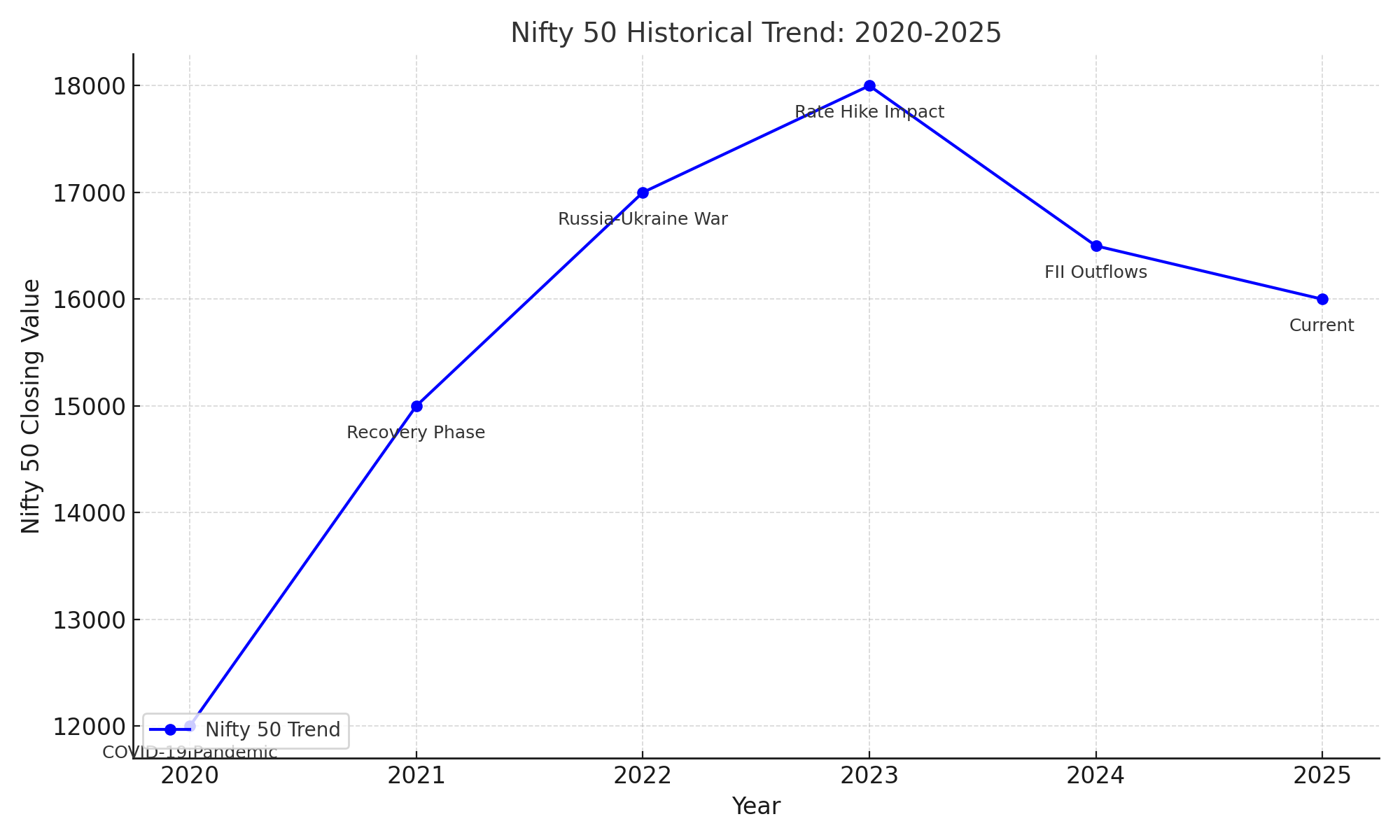

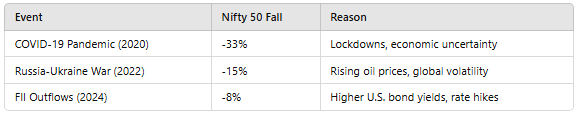

Historical Data: Indian Market Declines

Below is a chart showing significant market dips since 2020:

The historical trend of the Nifty 50 index from 2020 to 2025, showing key events such as the COVID-19 pandemic, recovery phase, geopolitical tensions, and foreign institutional investor (FII) outflows, has been plotted.

Sectors Most Impacted

Information Technology

- Major IT companies reported slower growth due to reduced global demand.

- The Nifty IT Index fell over 10% in the last quarter.

Banking and Finance

- Rising interest rates have led to lower credit growth and higher NPAs.

- Public sector banks saw the steepest decline in share prices.

Oil and Gas

- Higher crude oil prices and a weaker rupee have squeezed margins in this sector.

How Does This Affect Retail Investors?

- Mutual Fund Investors: Equity-focused funds are seeing lower returns. SIP investors should stay focused on long-term goals rather than reacting to short-term volatility.

- Direct Equity Investors: Value-buying opportunities exist in blue-chip stocks, but caution is necessary.

Future Outlook

Despite the current downturn, experts suggest that the Indian market still holds potential for long-term growth:

- The Indian economy is expected to grow at 6.5% in FY25, which remains among the highest globally.

- Structural reforms such as PLI schemes and digital infrastructure investments are likely to support recovery.

Tips for Investors During a Market Downtrend

- Diversify Investments: Spread your portfolio across sectors and asset classes to reduce risk.

- Focus on Fundamentals: Invest in fundamentally strong companies with growth potential.

- Avoid Panic Selling: Markets recover over time; avoid selling in a hurry.

- Track Global Trends: Keep an eye on international events that could affect the Indian market.

Conclusion

The Indian market’s recent decline is driven by a mix of global and domestic factors. While the downturn might appear concerning, it also presents opportunities for long-term investors. Staying informed, diversifying, and focusing on strong fundamentals are key strategies to navigate this phase.

👉 Explore more financial insights here: www.marfo.in