Magic of SIPs: The Journey from ₹5,000 a Month to ₹5 Crore

Investing is a journey that rewards patience and consistency. One of the most powerful ways to create wealth is through Systematic Investment Plans (SIPs) in equity mutual funds. With as little as ₹5,000 per month, disciplined investors have seen their investments grow to an incredible ₹5 crore in 25 years, thanks to the power of compounding.

In this blog, we explore how long-term SIPs work, real-life success stories, and why starting your SIP journey today can transform your financial future.

What is the Power of Compounding?

The key to long-term wealth creation lies in compounding. Compounding occurs when your returns are reinvested, generating further returns. Over time, this snowball effect leads to exponential growth in your investments.

Example of SIP Growth

- A ₹5,000 monthly SIP invested consistently for 25 years at an average annualized return of 15% can grow to approximately ₹5 crore.

- Total Investment: ₹15 lakh

- Total Returns: ₹4.85 crore (via compounding)

This example underscores how small, consistent investments can lead to massive wealth creation over time.

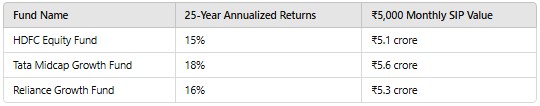

Success Stories: Top Performing Funds

Here are examples of equity mutual funds that have rewarded disciplined investors:

Note: Past performance does not guarantee future results.

Why SIPs in Equity Mutual Funds Work

- Rupee Cost Averaging: SIPs average out the cost of investments, reducing the impact of market volatility.

- Compounding: Returns are reinvested, amplifying growth over time.

- Convenience: Automated investments make SIPs hassle-free.

- Tax Benefits: Equity Linked Savings Schemes (ELSS) under SIPs offer tax deductions under Section 80C.

Benefits of Long-Term Investing

- Wealth Creation: SIPs provide a structured path to achieve financial freedom.

- Goal Achievement: Long-term SIPs help fund big-ticket goals like retirement, child education, or buying a home.

- Peace of Mind: Consistent investments offer stability and assurance for the future.

Steps to Start Your SIP

- Define Your Goals: Identify what you want to achieve financially.

- Choose the Right Fund: Select funds with a strong track record.

- Start Early: Begin your SIP journey as soon as possible to maximize compounding benefits.

- Stay Committed: Continue your SIPs even during market downturns for better long-term returns.

Explore top SIP options at Marfo.in and take the first step toward financial freedom.

Key Takeaways from the ₹5 Crore SIP Story

- A disciplined approach to investing pays off in the long run.

- Small amounts, like ₹5,000 per month, can grow into significant wealth with time and patience.

- SIPs mitigate market volatility and promote financial discipline.

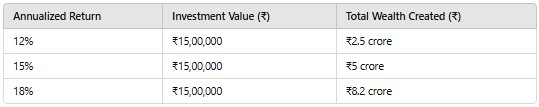

Chart: SIP Growth Over 25 Years

Below is a chart showcasing the growth of a ₹5,000 SIP over 25 years at different annualized returns:

Conclusion: Why Wait? Start Your SIP Journey Today

The story of transforming ₹5,000 per month into ₹5 crore is a testament to the magic of long-term investing. By embracing patience, discipline, and the power of compounding, you can turn modest savings into significant wealth.

At Marfo, we’re here to help you start your SIP journey and achieve your financial goals. Begin today and let your money work for you!

Can you also suggest from fund with time horizon of 10 years