Budget 2025-26: New Tax Regime vs. Old Tax Regime – A Comprehensive Comparison

The Union Budget 2025-26 has introduced crucial changes in India’s taxation policies, impacting individuals across different income brackets. With a focus on economic growth, tax simplification, and increased disposable income, the government has refined the new tax regime while retaining the old tax regime for those who prefer deductions.

In this article, we provide a detailed analysis of the latest tax slabs, savings comparisons, examples, and key takeaways to help you make an informed decision for FY 2025-26.

📊 Understanding the New and Old Tax Slabs (FY 2025-26)

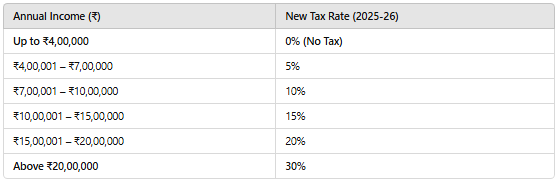

🔹 New Tax Regime (Post-Budget 2025) – Simplified Taxation

The new tax regime continues to offer lower tax rates with minimal exemptions, making tax filing easier for individuals who do not claim major deductions.

✅ Key Updates in the New Tax Regime:

✔️ Tax exemption limit increased from ₹3 lakh to ₹4 lakh

✔️ Standard deduction raised to ₹60,000 (for salaried individuals)

✔️ Tax rebate under Section 87A extended for income up to ₹12 lakh

✔️ Simplified tax filing with fewer deductions & exemptions

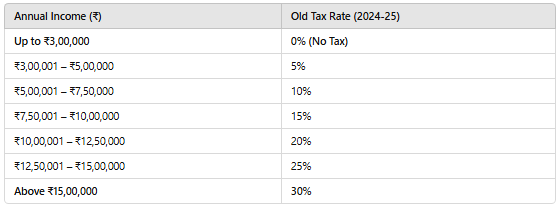

🔹 Old Tax Regime (Pre-Budget 2025) – Deduction-Based Savings

The old tax regime remains unchanged and continues to allow multiple deductions under Section 80C, 80D, HRA, LTA, and Home Loan Interest.

✅ Key Benefits of the Old Tax Regime:

✔️ Lower tax-free limit of ₹3 lakh

✔️ More tax brackets with higher rates for different income levels

✔️ Deductions available (PPF, EPF, LIC, Home Loan Interest, NPS, etc.)

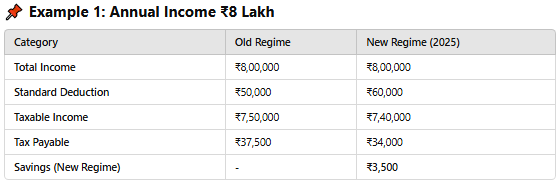

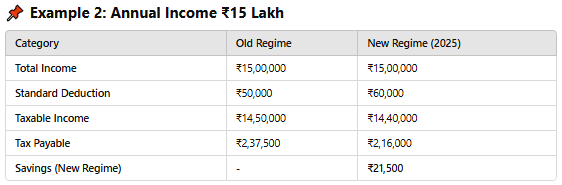

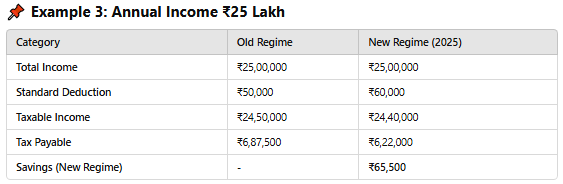

💡 Tax Savings Comparison: Old vs. New Regime (2025-26)

To help you understand the impact, let’s compare tax calculations under both regimes.

🧐 Which Tax Regime Should You Choose?

✅ Go for the New Tax Regime if:

✔️ You don’t claim major deductions like 80C, 80D, HRA, LTA

✔️ Your income falls between ₹7 lakh and ₹20 lakh (lower tax rates are beneficial)

✔️ You prefer a hassle-free tax filing process

✅ Stick to the Old Tax Regime if:

✔️ You have substantial tax-saving investments (PPF, EPF, LIC, Home Loan EMI, etc.)

✔️ You claim HRA & LTA deductions (especially for salaried professionals)

✔️ Your income is above ₹20 lakh, where deductions significantly lower your taxable income

📌 Key Takeaways from Budget 2025-26’s Taxation Changes

✔️ Higher exemption limits & standard deductions offer relief for middle-class taxpayers

✔️ Business owners & salaried individuals gain from increased disposable income

✔️ Wealthy individuals might face changes in surcharge and capital gains tax

✔️ Government’s balanced approach ensures fiscal stability while promoting growth

📢 Conclusion: What Should Taxpayers Do?

The Budget 2025-26 strikes a balance between taxpayer relief and economic sustainability.

📌 Salaried professionals should evaluate if they save more with deductions (Old Regime) or lower rates (New Regime)

📌 Businesses & investors should remain updated on further tax reforms

📌 High-income earners should plan finances as surcharge and capital gains taxation could change

For more insights on taxation, financial planning, and budget analysis, visit Marfo.in. 🚀💰

Stay Updated with Budget & Financial News!

💬 Which tax regime do you prefer? Are you switching from the old regime? Drop your thoughts below! 👇