HDB Financial IPO 2025: Dates, Price Band & Long-Term View

HDB Financial Services – a leading non-banking financial company (NBFC) backed by HDFC Bank – is set to launch a record ₹12,500‑crore IPO on June 25, 2025. The offering (open through June 27) includes ₹10,000 cr of HDFC Bank’s stake sale (OFS: Offer For Sales) and ₹2,500 cr of fresh equity.

This will be the largest IPO in India since Hyundai Motor’s ₹27,000 cr issue last year, and marks another HDFC Group listing after HDFC Bank and the merged HDFC entity. Analysts note that market sentiment is upbeat – India’s stock indices have rebounded sharply and liquidity is ample – which bodes well for strong subscription.

IPO Details:

| Particulars | Details |

|---|---|

| IPO Opening Date | June 25, 2025 |

| IPO Closing Date | June 27, 2025 |

| Anchor Investor Bidding | June 24, 2025 |

| Allotment Date | June 30, 2025 (Tentative) |

| Listing Date | July 2, 2025 (Tentative) |

| Issue Type | Book Built Issue (OFS + Fresh Issue) |

| IPO Size | ₹12,500 crore |

| Offer for Sale (OFS) | ₹10,000 crore (by HDFC Bank) |

| Fresh Issue | ₹2,500 crore |

| Price Band | ₹700 – ₹740 per share |

| Lot Size | 20 shares |

| Minimum Investment (Retail) | ₹14,800 (at upper band) |

| Face Value | ₹10 per equity share |

| Retail Investor Quota | 35% |

| QIB Quota | 50% |

| HNI/NII Quota | 15% |

| Reserved Categories | HDFC Bank Shareholders, Employees |

| Promoter | HDFC Bank |

| Registrar | Link Intime India Pvt Ltd (Tentative) |

| Listing Exchanges | NSE & BSE |

Company Profile:

HDB Financial Services Ltd (est. 2007) is a Mumbai-based NBFC-UL (upper-layer NBFC) and was a wholly-owned subsidiary of HDFC Bank. It provides consumer and enterprise finance: personal loans, business loans, vehicle and asset finance, gold loans, and loans against property. HDB has a pan-India omni-channel presence (over 1,400 branches) serving ~19.2 million customers, with a focus on affordable credit for individuals and small businesses. It follows regulatory trends – RBI rules now require large NBFCs to list by Sep 2025 – and this IPO is part of HDFC’s strategy to optimize capital while complying with that mandate.

Financial Performance:

HDB’s loan book and earnings have been growing briskly. In FY2024 (ended Mar ’24) total assets were ~₹1,019.6 bn, revenue ₹78.9 bn and PAT ₹11.7 bn en.wikipedia.org. By Q4 FY2025, loan assets reached ₹1,069 bn (up ~18.5% YoY) hdfcbank.com and quarterly profit was ₹5.3 bn (EPS ₹6.7). Asset quality is solid: gross Stage-3 (non-performing) loans are only ~2.3% and the capital adequacy ratio ~19.2%. For FY2025 (annualized), analysts estimate AUM of ~₹1,073 bn and PAT around ₹21.8 bn, reflecting continued robust growth.

HDFC Bank Parentage:

HDFC Bank holds ~94% of HDB FS and is the sponsor of the IPO. The sale of ₹10,000 cr of shares (through OFS) and issuance of fresh equity is partly to meet RBI’s NBFC listing deadline and bolster HDB’s capital. After IPO, HDFC’s stake will shrink significantly (est. to ~75–80%), but the bank remains committed to HDB’s growth. This is the first major HDFC Group float since the merger of HDFC with HDFC Bank, underscoring confidence in the NBFC’s prospects

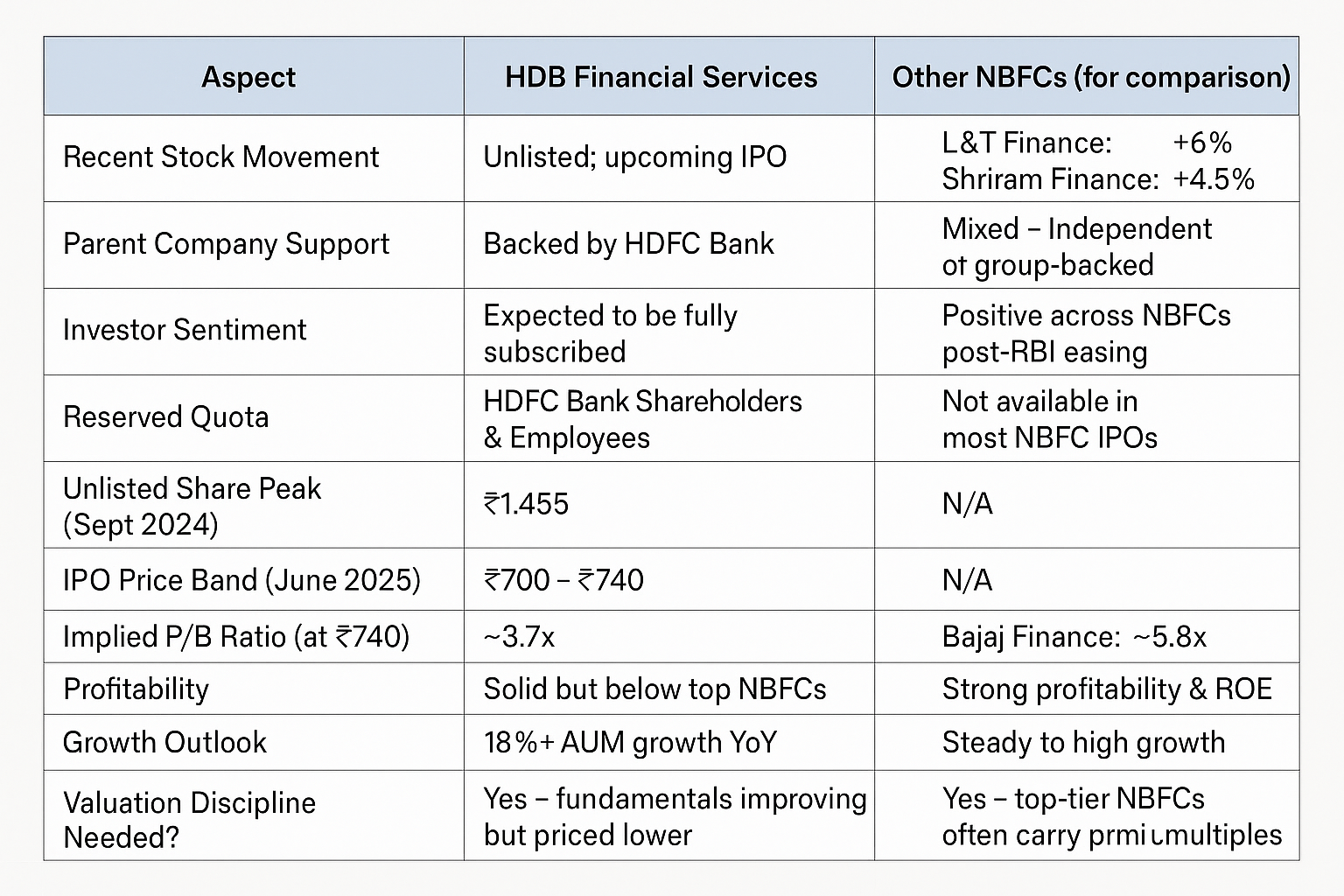

Market Sentiment & Comparisons:

The IPO is happening in a favourable environment for NBFCs. Recent RBI policy easing (cutting risk weights for NBFC lending) has seen NBFC stocks rally – e.g. L&T Finance +6%, Shriram Finance +4.5% and Bajaj Finance +2.4% in one session – suggesting strong investor appetite for credit plays. Analysts also expect the HDB IPO to be fully subscribed, citing its strong parentage and a reserved quota for HDFC Bank shareholders.

However, valuation discipline is important. HDB’s unlisted shares peaked at ₹1,455 (Sept 2024) but have since corrected; at the IPO upper band, the implied P/B ratio is ~3.7x. This is below valuations of top NBFCs (e.g. Bajaj Finance ~5.8x). Even so, experts caution that investors should not chase hype without due diligence, since HDB’s fundamentals (especially profitability) remain a bit lower than market leaders.

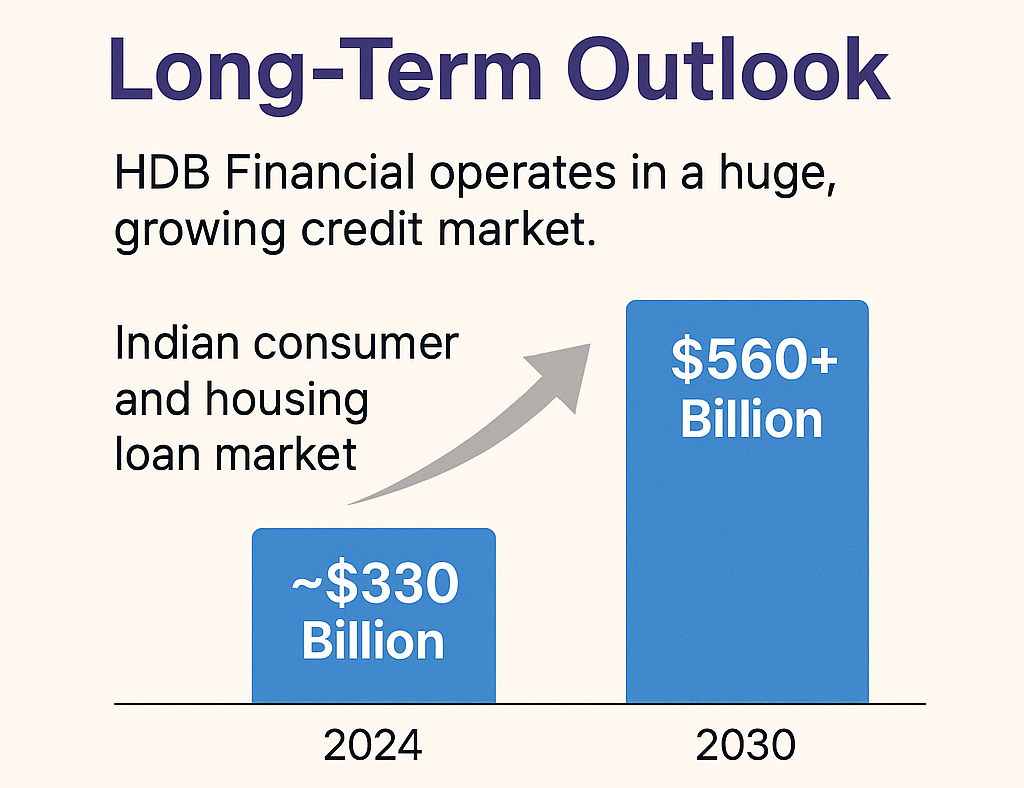

Long-Term Outlook:

HDB Financial operates in a huge, growing credit market. The Indian consumer and housing loan market is projected to grow from ~$330 billion in 2024 to over $560 billion by 2030, driven by urbanisation and rising incomes. HDB’s focus on affordable finance and tie-ups with equipment manufacturers and dealers positions it well to capture this growth. The NBFC’s adoption of tech (digital lending, AI underwriting) and diversified funding sources (bank lines, bonds, etc.) bolster its competitive edge en.wikipedia.orgen.wikipedia.org.

Risks and Valuation:

On the flip side, HDB faces sector risks: any slowdown in credit demand, interest-rate hikes, or asset-quality shocks could impact its returns. Competition is fierce (banks, fintech) and regulations (like higher risk-weights on unsecured loans) may tighten profit margins. Valuation is another consideration: at ₹740/share, HDB’s P/B ~3.7x. Some investors compare this to Bajaj Finance (traditionally premium-valued) or to peers like Cholamandalam (~5.5x P/B). While HDB’s pricing is more conservative, long-term gains depend on consistent growth and maintaining low defaults.

Overall, the HDB Financial IPO offers a chance to invest in a fast-growing NBFC with strong backing. But buyers should weigh the business potential (large loan book growth, HDFC Bank synergies) against valuation and sector risks.

In summary, HDB Financial Services’ IPO combines scale (₹12,500 cr issue), growth (accelerating loan book, ~20%+ CAGR), and HDFC Bank support. It’s likely to draw keen interest from institutions and retail (especially HDFC shareholders). Investors should note the RBI listing mandate and NBFC tailwinds driving the deal, but also practice caution on pricing.

✅ Ready to Invest in the HDB Financial IPO?

Don’t miss your chance to participate in one of India’s biggest NBFC IPOs!

Open a free Demat account with Angel One via Marfo – it’s 100% paperless and only takes a few minutes.

Enjoy ₹0 brokerage on delivery trades and gain instant access to IPOs, stocks, mutual funds, and more.

Stay ahead with real-time market updates and smart advisory tools through the Angel One platform.

👉 Open Your Free Demat Account Now

Secure your spot in the HDB Financial IPO with just a few clicks!