RBI Repo Rate Cut June 2025:

- What It Means for Home Loans, EMIs, and the Indian Economy

RBI Cuts Repo Rate to 5.50% – A Game Changer for Borrowers and the Economy

In a proactive move to accelerate growth and reduce borrowing costs, the Reserve Bank of India (RBI) slashed the repo rate by 50 basis points, bringing it down from 6.00% to 5.50% during its June 2025 MPC meeting. This is the third repo rate cut in 2025, totaling a 100 bps reduction since January.

The decision also included a 100 basis point cut in the Cash Reserve Ratio (CRR) to 3%, injecting an estimated ₹2.5 lakh crore into the banking system. Together, these changes are aimed at improving liquidity, enhancing credit flow, and making borrowing more affordable for individuals and businesses.

The last repo rate cut by Monetary Policy Committee (MPC), in its 54th meeting and the first of the financial year 2025–26, unanimously decided to reduce the policy repo rate by 25 basis points, bringing it down to 6 per cent with immediate effect.

Why Did RBI Cut the Repo Rate?

Several key factors prompted the RBI to reduce the repo rate:

✅ Easing inflation, now projected to stay below 5%

📉 Weak private consumption and slowing rural demand

🌐 Global uncertainties weighing on exports and investor confidence

🏦 Sluggish credit growth among MSMEs and consumers

💡 Encouraging lending and investment through improved liquidity

What is the Repo Rate?

The repo rate is the rate at which the RBI lends short-term money to commercial banks. A lower repo rate reduces the cost of funds for banks, which can translate into lower loan interest rates for consumers and businesses.

🏦 Repo Rate vs Reverse Repo Rate: What’s the Difference?

Understanding both the Repo Rate and the Reverse Repo Rate is crucial to grasp how RBI manages liquidity and inflation in the Indian economy:

| Term | Meaning | Who Benefits | Current Rate (June 2025) |

|---|---|---|---|

| Repo Rate | The rate at which RBI lends money to commercial banks when they need short-term funds | Borrowers (loans become cheaper as banks get funds at lower cost) | 5.50% |

| Reverse Repo Rate | The rate at which RBI borrows money from commercial banks to absorb excess liquidity | Depositors (higher rates help banks park surplus funds with RBI) | 3.50% |

✅ Key Difference:

Repo Rate = RBI gives money to banks ➝ impacts loan interest rates

Reverse Repo Rate = RBI takes money from banks ➝ used to control inflation and absorb surplus funds

When RBI reduces the repo rate, borrowing becomes cheaper, encouraging more spending and investment.

When RBI raises the reverse repo rate, it encourages banks to park funds with RBI, reducing excess liquidity in the market.

Why It Matters for You:

🏠 Lower repo rates = lower EMIs on home, car, and personal loans

💰 Higher reverse repo rates = better deposit rates (in some cases)

📉 Both are tools to balance inflation vs growth

MCLR Transmission: Will You Actually Benefit?

While the repo rate cut is a positive signal, the actual benefit for borrowers depends on how quickly banks reduce their Marginal Cost of Funds-based Lending Rates (MCLR) — the benchmark rate for most retail loans.

“With the RBI announcing a third rate cut this calendar year, bringing the total repo rate reduction to 100 basis points (bps), we’re seeing a gradual but positive shift for borrowers. Although each cut, including the recent 50 bps reduction, may seem modest in isolation, cumulatively they help ease the overall cost of borrowing,”

— Deepak Kumar Jain, Founder & CEO, CredManager.in, a loan distribution platform.

Real Savings: How Much Will Your EMI Drop?

The EMI savings may appear small per month, but they add up significantly over time:

🏠 ₹50 lakh home loan over 20 years: EMI down by approx ₹3,164/month

🏠 ₹1 crore home loan: Savings of around ₹6,329/month

🏠 ₹1.5 crore home loan: Savings of approx ₹9,493/month

Over the loan tenure, these reductions lead to substantial savings, especially important in high-cost urban housing markets.

Impact on FD Returns and Investments

While borrowers benefit, depositors may see lower interest rates on fixed deposits (FDs) and savings accounts. Investors are advised to explore:

🔄 Debt mutual funds

📊 Government bonds & tax-free bonds

📈 Hybrid and market-linked products

Diversifying becomes key in a falling interest rate environment.

Broader Economic Outlook

This policy shift is expected to:

⚙️ Boost credit demand and business lending

🏘️ Revive growth in the real estate and auto sectors

📉 Improve affordability for first-time homebuyers

📈 Support GDP growth projections of 7.2% for FY26

What Should You Do Now?

At www.marfo.in, we help you navigate the impact of rate cuts with expert tools and personalized support. Here’s what you can do:

✅ Compare home loan rates and find better offers

🔁 Use our Home Loan Balance Transfer tool to save on EMIs

📊 Explore alternative investment options

🛡️ Secure your financial future with term & health insurance

📈 Open a Demat account with Angel One to invest smartly

Open Your Angel One Account with Marfo

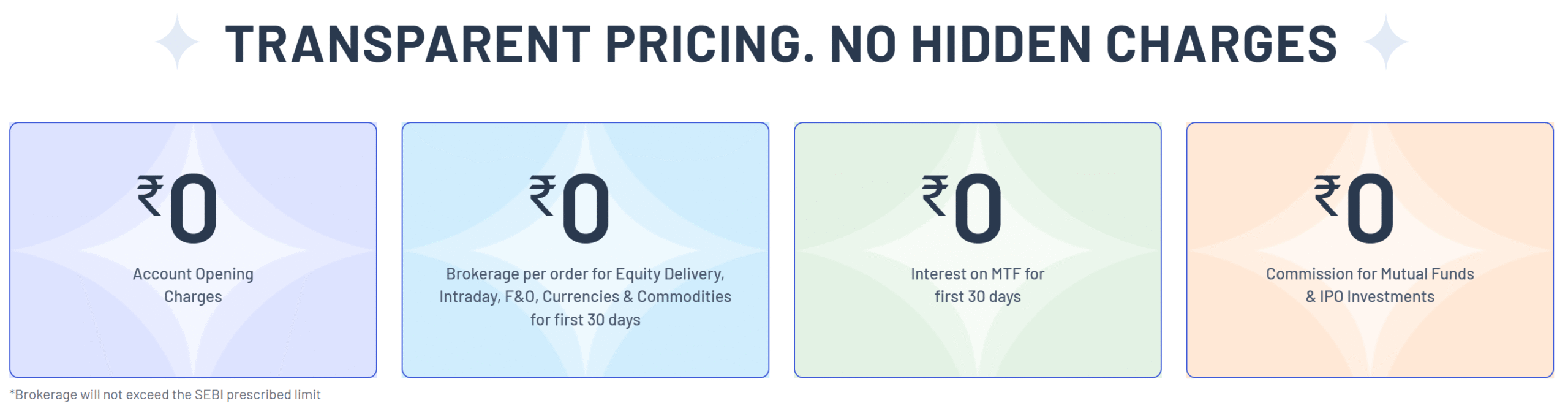

If you’re ready to invest in IPOs, FPOs, OFS, or Rights Issues, having the right trading platform is essential. Marfo, in collaboration with Angel One, makes it easy for you to open a Demat and trading account online. With Angel One, you enjoy benefits like zero brokerage on equity delivery, a flat ₹20 charge on intraday and F&O trades, and access to advanced tools like ARQ Prime for smart investment recommendations. The entire process is paperless and takes just 48 to 72 hours. Open your Angel One account through Marfo.in today and take your first step toward smarter investing.

✅ Angel One Demat Account Benefits:

Free account opening (zero cost!)

Low brokerage – ₹20/order or FREE for delivery trades

Smart trading platforms – Web, mobile & desktop apps

AI-based stock suggestions & research

24/7 support and easy onboarding

🎯 Start Investing Smart

👉 Open Your Free Demat Account with Angel One Now

Final Thoughts

The RBI’s repo rate cut in June 2025 is more than just a monetary adjustment — it’s an opportunity. If you’re planning to buy a home, refinance a loan, or restructure your finances, this is the best time to act. Keep an eye on MCLR changes, stay updated, and let Marfo.in help you make the right financial moves.