Q-square & R-square Analysis :-

A Guide to Predictive Accuracy in Financial Modelling

Introduction

In the competitive world of finance, predictive models are essential for crafting accurate investment strategies and mitigating risks. Among these models, Q-Square Analysis plays a pivotal role by measuring predictive relevance, which is critical in making real-world financial decisions. When paired with R-Square Analysis, Q-Square enhances a model’s ability to balance explanatory power and predictive accuracy.

This blog explores Q-Square Analysis, its relevance in mutual fund investments, a comparison with R-Square, and actionable examples to improve your financial modelling. To dive deeper into investment strategies and analysis tools, visit Marfo.in.

What is Q-Square Analysis?

Q-Square Analysis is a statistical tool used in Partial Least Squares Structural Equation Modelling (PLS-SEM) to evaluate the predictive relevance of a model. Unlike R-Square, which assesses variance explained, Q-Square focuses on the model’s ability to predict future outcomes effectively.

Key Features

- Predictive Relevance: A high Q-Square value indicates the model’s capability to make reliable predictions.

- Validation Framework: It utilizes separate training and testing datasets to ensure robust predictions.

- Practical Use Cases: Ideal for financial modelling, such as forecasting mutual fund performance or assessing market risks.

Example in Mutual Fund Performance

Imagine an investor using a model to predict the Net Asset Value (NAV) of a mutual fund. Historical NAVs from 2015–2020 serve as the training data, while 2021–2023 NAVs are used for testing. By calculating the Q-Square, the investor ensures the model is effective for future predictions.

How is R-Square Different from Q-Square?

While R-Square measures the proportion of variance explained by the independent variables, Q-Square assesses the predictive accuracy of the model.

Key Comparisons

| Aspect | Q-Square | R-Square |

|---|---|---|

| Purpose | Predictive accuracy | Explanatory power |

| Focus | Real-world predictions | Historical variance analysis |

| Applications | Financial forecasting, mutual funds | Regression and model fitting |

For instance, while R-Square can tell you how much of a fund’s performance can be explained by market indices, Q-Square will reveal how accurately the model predicts future performance.

Explore more about financial tools on our Investment Resources Page.

Learn more about regression analysis in this detailed guide from Investopedia.

Benefits of Q-Square Analysis in Finance

- Improves Predictive Modelling: Helps in crafting models that are more aligned with market realities.

- Enhances Risk Management: Validates models predicting market volatility or credit risks.

- Boosts Investment Returns: By refining predictions, investors can make more informed decisions.

- Supports Portfolio Benchmarking: Ensures competitiveness by testing models against industry standards.

Example Calculation: Q-Square in Action

Scenario

An analyst develops a model to predict the performance of a mutual fund using data on market trends, fund size, and expense ratios.

Data Used

- Training Data: NAVs from 2015–2020.

- Testing Data: NAVs from 2021–2023.

Steps

- Compute actual NAVs for 2021–2023.

- Use the model to predict NAVs for the same period.

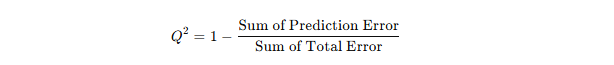

- Calculate Q-Square using the formula:

If the model predicts NAVs with a high Q-Square value (e.g., 0.85), it confirms the model’s robustness.

Using Q-Square and R-Square Together

For a balanced evaluation, use R-Square to assess model fit and Q-Square to test predictive relevance. Together, they provide a comprehensive view of a model’s effectiveness, particularly for financial forecasting and investment strategies.

How to Implement Q-Square Analysis

- Data Preparation: Gather and split datasets into training and testing sets.

- Model Development: Build a predictive model based on historical data.

- Testing: Use the model to predict outcomes for the testing set.

- Validation: Calculate Q-Square and interpret its value to ensure real-world reliability.

For tips on creating investment strategies, visit our guide on Investment Modelling Techniques.

Conclusion

Q-Square Analysis is a must-have tool for financial analysts and investors aiming to enhance their predictive models. When combined with R-Square, it ensures that financial models are both accurate and reliable for real-world applications. From mutual fund performance forecasting to risk management, Q-Square delivers actionable insights that drive better decisions.

Stay ahead in the financial landscape by leveraging cutting-edge tools and strategies. Explore more at Marfo.in.